cryptocurrency tax calculator australia

ATO Tax Reports in Under 10 mins. Swyftxs cryptocurrency tax calculator Australia gives you an estimate of what tax youll pay on profit made from a crypto sale.

Crypto Tax In Australia The Definitive 2021 2022 Guide

On December 17 2014 ATO guidance on cryptocurrency taxation went into law.

. The formula for calculating accessible income is Income Capital Gains Deductions. Crypto Trader Tax is one of the most popular cryptocurrency tax calculator platforms on the web. Cryptocurrency is complicated and adding in taxes can be headache-inducing.

History of Australian cryptocurrency taxes. Crypto tax breaks. Buy bitcoin other cryptos w ease.

Like Canada Australia distinguishes between crypto traders and investors for Capital Gains Tax. Cryptocurrency generally operates independently of. Australian taxpayers get a little breathing space with a number of tax-free thresholds and allowances that happily apply to cryptocurrency tax too.

In this guide we look at the basics of cryptocurrency tax in Australia to help you learn. Ad Build a portfolio for the future of money. The cryptocurrency tax calculator provides users with an estimate of the capital gains tax incurred when a cryptocurrency asset is sold traded or otherwise disposed of.

Calculate your cryptocurrency tax in minutes. With over 300000 users CoinTrackinginfo is one of the oldest and most trusted cryptocurrency tax calculators on the market today. Import your cryptocurrency data and calculate your capital gain taxes in Australia instantly.

Cryptocurrency generally operates independently of a central bank central authority or government. Before we get started its important to understand how the australian tax office ato defines the tax treatment of cryptocurrency in australia. Download your tax reports in minutes and file with TurboTax or your own accountant.

Buy sell and store bitcoin ether 70 cryptos. However its best to speak to a tax accountant who specialises in cryptocurrency for further advice. Create a free Gemini account in minutes.

It provides users with an extremely user-friendly app which can be connected to all of their exchange platform accounts to seamlessly pull all the necessary transaction history data needed to get an accurate overview of the users tax slots. Tax treatment of cryptocurrencies. In order to use the cryptocurrency tax calculator effectively youll need to provide a number of specific details about the cryptocurrency asset you have.

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your invididual circumstances. Full support for US UK Canada and Australia and partial support for others. Crypto is also GST-free.

While taxes can be deathly dull they dont have to. The original software debuted in 2014. Two things in life are certain.

CoinTracker helps you become fully compliant with cryptocurrency tax rules. For example you might need to pay capital gains on profits from buying and selling cryptocurrency or pay income tax on interest earned when holding crypto. The Australian Tax Office classifies cryptocurrency as a property or a capital gains tax asset.

As a cryptocurrency investor the amount of tax you pay is based on your overall assessable income. Using The Australian Cryptocurrency Tax Calculator. If youve been trading cryptocurrencies on Binance Australia or participating in other cryptocurrency-related activities in the last financial year you may have an obligation to report your activities in your next tax return.

Income - Tradings GainsLosses Deductions. The term cryptocurrency is generally used to describe a digital asset in which encryption techniques are used to regulate the generation of additional units and verify transactions on a blockchain. When you buy cryptocurrency in Australia you are not taxed as long as you purchase with a fiat currency Australian dollars US dollars British pounds etc.

How is crypto tax calculated. If you held your cryptocurrency for more than 12 months you apply a cgt discount of 50 475000 net capital gain. CoinTrackinginfo - the most popular crypto tax calculator.

Become tax compliant seamlessly. As with most other countries Australians calculate their taxes owed based on the fiat value of the crypto at the time of the transaction. For cryptocurrency traders the formula differs a bit.

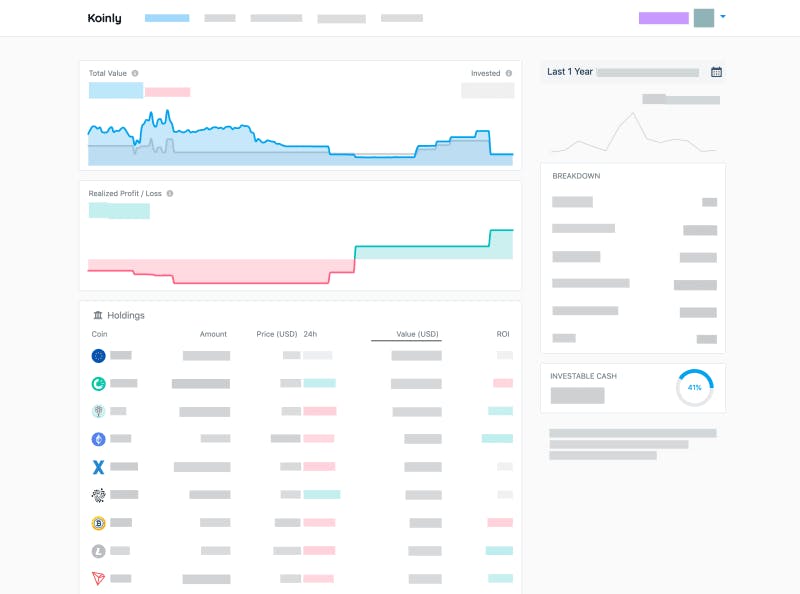

This guide breaks down everything you need to know to get your Australian cryptocurrency taxes filed with the Australian Taxation Office ATO. You will only start to pay Income Tax when your hit 18200 in total income per year. Koinly is the only cryptocurrency tax calculator that is fully compliant with ATOs crypto tax guidance.

Our Australian crypto tax calculator is the perfect tool whether you are a beginner trader or an experienced crypto king. Since then its developers have been creating native apps for mobile devices and other upgrades. ATO has a sliding scale of individual tax rates that you can use to determine the tax owed.

10 common faqs on crypto tax in australia. Crypto Tax Calculator for Australia.

![]()

Cointracking Crypto Tax Calculator

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker

![]()

Cointracking Crypto Tax Calculator

Koinly Crypto Tax Calculator For Australia Nz

Australia Tax Rates For Crypto Bitcoin 2022 Koinly

Cryptocurrency Taxes In Australia 2021 2022 Guide Cointracker